To download the October 2020 Auto Aggregate PDF, click here.

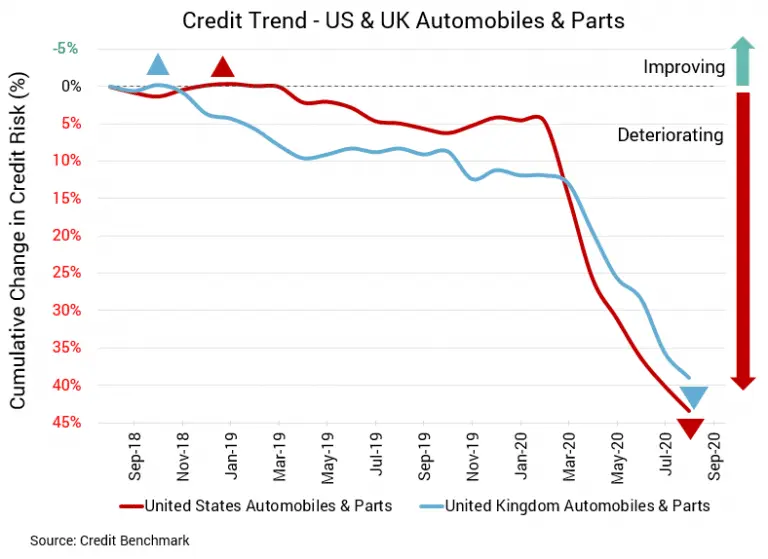

The worst may not yet have arrived for the US auto industry. In fact, there were some signs of recovery in Q3. But when a smaller-than-expected drop in sales is considered a good sign, it’s no surprise the credit quality for the industry is still in poor shape. The UK is experiencing similar issues, and is also dealing with concerns about Brexit. What’s more, a growth in COVID cases continue to weigh on economic recovery in each country.

Default Risk Significantly Higher for UK Auto Sector

- Credit quality for the US, UK auto firms is down by double digits from the same point last year

- UK auto sector firms are in a worse position; having a greater probability of default

US Auto and Auto Parts Industry

Deterioration of credit quality for the US auto sector is getting worse. US auto and auto parts firms’ credit quality is down about 2% from the prior month. The minor change obscures the long-term declines, with credit deterioration of about 37% from six months prior. The year-over-year drop is also about 37%, as credit quality was largely stable prior to the COVID-19 crisis. Average probability of default is about 50 bps, compared to about 49 bps the prior month and 37 bps six months prior and at the same point last year. Approximately 82% of firms have CBC rating of bbb or lower. The aggregate’s average CBC rating is bbb-.

UK Auto and Auto Parts Industry

UK auto and auto parts firms experienced about a 2% decline in credit quality from the prior month, about 24% decline from six months prior, and about 28% decline from the same point last year. This clear drop in credit quality has led to big increases in default risk, leaving the UK aggregate’s risk far higher than that of the US. Average probability of default is about 74 bps, compared to about 73 bps one month earlier, 60 bps six months earlier, and 58 bps at the same point last year. Approximately 87% of firms have CBC rating of bbb or lower. The aggregate’s average CBC rating is bb+.

About Credit Benchmark Monthly Auto Industry Aggregate

This monthly index reflects the aggregate credit risk for US and UK firms in the automobile and auto parts sectors. It illustrates the average probability of default for auto firms as well as parts suppliers to achieve a comprehensive view of how sector risk will be impacted by trends in the auto industry. A rising probability of default indicates worsening credit risk; a decreasing probability of default indicates improving credit risk. The Credit Benchmark Consensus (CBC) Rating is a 21-category scale explicitly linked to probability of default estimates sourced from major financial institutions. The letter grades range from aaa to d.